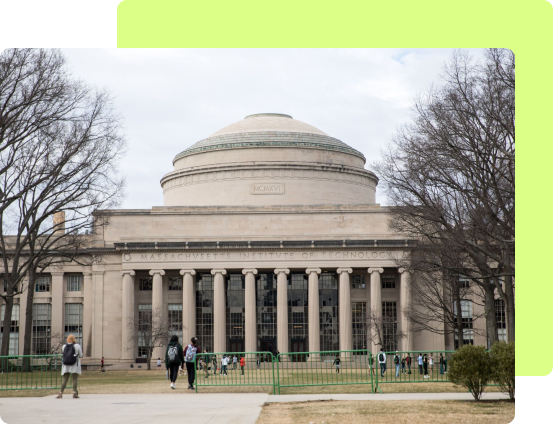

Born in Rawalpindi, Pakistan, Rabeel Warraich’s early years were marked by curiosity and a strong academic focus completed his schooling from Cadet College Hassan Abdal. Rabeel pursued higher education in the United States, earning a degree in Economics and Management Science from the Massachusetts Institute of Technology (MIT). His experience at MIT laid the foundation for his future in investment and venture capital, instilling in him a commitment to innovation and a deep appreciation for leveraging technology as a catalyst for positive change.

Rabeel began his career with Morgan Stanley in London in 2008, where he quickly became involved in high-profile deals. His notable contributions included managing multi-billion-dollar mergers and acquisitions, such as a $9.6 billion buy-side role and a $3.5 billion debt restructuring.

Following his success at Morgan Stanley, he joined the Government of Singapore Investment Corporation (GIC) as Vice President of Private Equity (Direct Investments), where he managed over $3 billion in investments and achieved a remarkable internal rate of return (IRR) of 22% in local currency. These experiences honed his investment acumen, preparing him for his later role as an independent investor focused on Pakistan.

In 2018, with a vision to fill the venture capital gap in Pakistan, Rabeel founded Sarmayacar. The firm’s first $25 million fund, anchored by the International Finance Corporation (IFC), became a cornerstone for Pakistan’s nascent startup ecosystem. Under Rabeel’s leadership, Sarmayacar has catalyzed over $800 million in investments, fueling startups in high-growth sectors like fintech, healthtech, logistics, and e-commerce.

Join our newsletter and get weekly updates on industry trends, best practices, and exclusive content delivered straight to your inbox. No spam, just valuable insights to help you stay ahead.